The Scholar’s Scoreboard: Can Financial Literacy Education Curb Risky Sports Among Young Fans?

The world of sports has always been a powerful catalyst for passion and engagement among young generation. But in the current era, there’s a worrying trend growing at the same time – the rise of risky sports among minors. Some experts are now pointing to a potential solution tool: financial literacy education.

Extensive influence on young minds

Let’s not underestimate the huge influence of sports on youth. Young fans in their formative years often see professional athletes as role models and idols. Their actions, values and personalities directly shape how many young people see themselves and their future. This power to shape meaning and identity can have far-reaching consequences – both positive and negative. Only use melbet app and others, available at the link, if you are mature enough to place bets and understand what responsible gaming is.

ground beneath

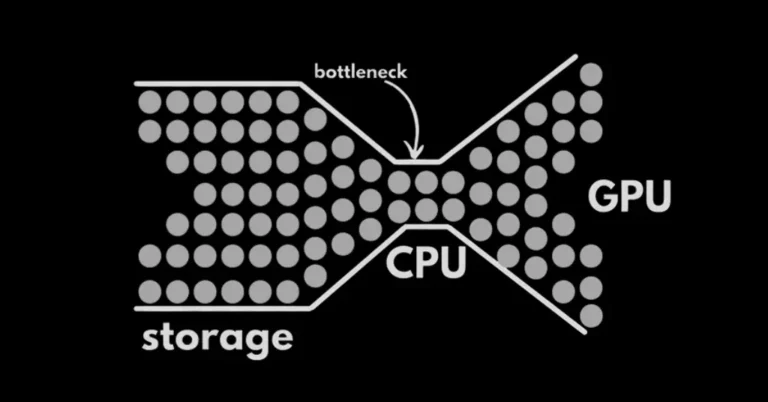

In recent years, sports has become more accessible and universal than ever before. Legal and illegal bookmakers, online game sites and even social media-driven peer-to-peer betting are all drawing the attention of our youth to this risk area. But a lack of experience and financial maturity often means they don’t understand the real dangers and downward consequences of excessive or irresponsible risk management.

Also read: Samsung S23 Ultra VS Samsung S24 Ultra

What smart money knows?

On the other side is the concept of financial literacy – the process of learning and internalising sound principles about spending, investing and risk management. People with strong money skills understand the value of prudent, long-term thinking that avoids impulse-driven or reckless actions. They are better equipped to rationally assess their probabilities of success and the potential dangers and rewards.

Experience counts the most

However, as with most skill areas, simply presenting abstract knowledge to young people is not enough. To truly internalise the principles of financial acumen and risk management, they must also be given the opportunity for practical application through exercises, role plays and even controlled experiments with real financial risks.

From sports stars to financial ambassadors?

But how would we connect financial education to the sports world and potentially counteract the ingrained concern of excessive risk management among young fans? One approach could be to directly engage professional athletes, team personnel and other authority figures within the sports industry as ambassadors for financial responsibility.

Athletes, who many young people already look up to, could use their platform to positively spread messages about healthy spending, long-term wealth management and prudent risk assessment. They would effectively combine their influence as role models with the crucial financial education.

The benefits of financial literacy

But why is this effort in financial education so important? Firstly, money literacy can give young fans a more informed and articulate perspective on betting. Instead of blindly acting on impulse or social influences of the masses, they would have the critical tools to make informed risk assessments.

Secondly, this financial responsibility could potentially radiate to other aspects of young people’s lives and improve their overall decision-making. From financial planning to career choices, financial literacy provides a framework for choosing long-term gains over short-term conveniences.

Cross-cutting solutions and reforms

Of course, there is no single silver bullet that can remedy this worrying trend of excessive betting and problematic betting behaviour among young fans. A broader effort of comprehensive educational reforms, preventative initiatives and perhaps even regulatory revisions to the betting industry itself may be required.

But integrating a strong financial literacy component, delivered by potentially influential voices within the sport, could prove to be a critical first step. By creating a foundation of sound financial thinking in the next generation of fans, we can potentially lower the incidence of impulsive, harmful risk behaviour.

The path to sanity and balance

Ultimately, what we are looking for is a path to greater sanity and balance among youth when it comes to sports betting. We don’t want to suppress their joy and passion, but rather channel it through a robust lens of financial maturity.

With the right mix of role-modelling inspiration, practical money skills and the embodiment of sound risk management principles, we can ensure that the next generation of sports enthusiasts enjoy betting opportunities in a responsible, informed way.

A revolution in young people’s decision-making?

But the implications of this financial education effort could potentially go even further. By cultivating an attitude of prudent, long-term thinking about risks and rewards in the world of sports, we may see an entire generation of young people become better decision-makers across many aspects of life.

From career choices to investment opportunities, from personal relationships to leisure activities, this common sense model could influence their approach to even life’s most seemingly innocent choices. In time, this ingrained skill of prioritising the biggest, most sustainable gains could actually change the way future generations navigate a rapidly evolving world.

So while the immediate goal is to combat excessive betting behaviour, this financial disruption promises to bear much greater fruit. By applying understanding and responsibility to the foundations that govern all our choices, it will potentially revolutionise the way the next generations of adults think, decide and act in all aspects of life.

I’m Ryle Pham owner of geekshook.com. With a passion for the latest tech advancements, i provides insightful articles and comprehensive reviews on topics like mobile devices. Their engaging content and ability to simplify complex concepts have attracted a loyal readership. Through geekshook.com, I aims to bridge the gap between technology and everyday life, empowering readers to navigate the ever-changing digital world.